Forbes projects “embedded finance will generate $230 billion in revenue by 2025, a 10x increase from $22.5 billion in 2020” (Forbes). Sounds great. But have you tried to figure out what “embedded finance” actually is?

An array of industry-speak and jargon buries the true meaning of embedded finance: Embedded Banking, Embedded Payments, Banking as a Service, Finance as a Service, Payments as a Service. BankTech, PayTech, LendTech, and so on.

Simply put, embedded finance has everything to do with the flow of money. It’s when banks or other financial service providers help you, the software provider, offer financial products as features in your software. Often the industry conversation is limited to payment acceptance, but that’s only part of the story.

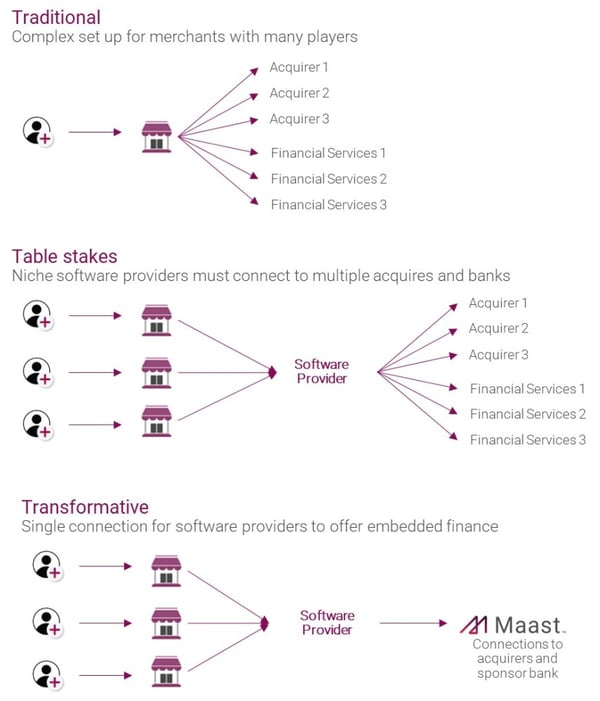

Software providers with vision can see this value. However, this often requires several solutions across multiple providers to deliver payment acceptance, bank accounts, debit cards, lending, and more.

This leads to multiple relationships, complex integrations, and clunky customer experiences. And, often banking services are provided through a third-party tech company that requires a bank sponsor to comply with federal and state regulations, adding even more complexity.

There’s a better way.

Cater to your customers' needs

Most business owners seek solutions to specific needs, usually when it’s urgent; they need a loan to buy a new vehicle, payment processing when they adopt a new point-of-sale system, a bank account when they set up a new company or subsidiary, insurance when they acquire real estate, or an accountant when Tax Day is coming. Simplicity is also vitally important.

The trick is to have the right solution when the business owner needs it and to make it super easy to get started. The most efficient models are typically a three-step process:

- Enroll: Business owners sign up with your software

- Identify: Look for signs a business owner needs additional services like business checking, payment acceptance, loans, or more

- Simplify: Make the services your business owners need readily and easily available

An end-to-end financial services strategy can help you create value for your customers by making the right products available at the right time, and by making those products super easy to consume.

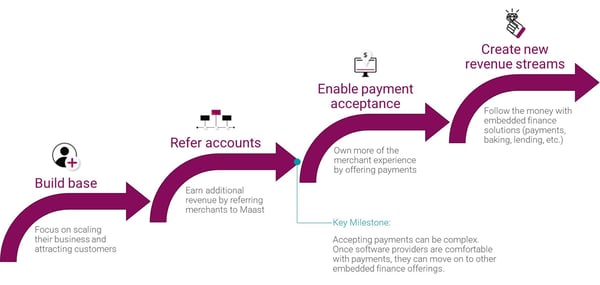

Payment acceptance is only the beginning

Software providers continuously enhance their platforms with valuable features to attract new merchants, increase revenue per customer, and deepen existing relationships. While payment processing has been a proven path to success, it’s no longer a differentiator. Other embedded finance offerings, like banking and lending, can enhance value, create new revenue streams, and improve relationships.

What has the potential to make you the all-in-one provider, tackling the most crucial business owner needs? That’s right, true embedded finance. With a wider breath of services you can drive more value and, as a result, make more money.

Five things to look for in an embedded finance partner

When researching the right partner be thoughtful and lead with a fact-based approach. You should ask yourself:

- Do they offer a comprehensive and relevant suite of financial services? Many are billing themselves as "embedded finance providers." Ask yourself if they can deliver on the breadth of needs that your customers have or are they specialists who can only serve one need.

- Do they help you grow your business? Consider how a provider could help you identify and fulfill your needs, make integration easy, and provide new sources of revenue.

- What is the brand experience like for business owners? Business owners trust you with the software to run their business. Maintaining your brand, instead of a provider's, helps to further extend that trust and creates better experiences. Picture a debit card with your logo as a portable billboard!

- What is the developer experience like? Your tech teams or person should be able to experiment with the APIs in a free sandbox before committing to full integration, production, and certification.

- How is the embedded finance provider being funded? Be mindful of fintech startups waiting on the next round of outsider funding to innovate and evolve. Ask yourself whether they will be around if there's an economic downturn and who is likely to buy them. It's also good to consider if the provider is even good at financial services. A partner backed by a bank with a long history of growth and innovation is likely to be far more stable and skilled. Your customers trust you. You should trust your provider.

Choosing the right embedded finance partner allows you to remain focused on your core business while also becoming a hub for business owner activity. A partner like Maast make the allure of easy and holistic embedded finance a reality.

Visit maast.com to learn more about how you can bank on your platform with Maast.