There are likely two scenes that come to mind from the beloved 1996 film Jerry Maguire. The first is arguably one of the most romantic cinematic moments, and the other introduces one of the best-known movie quotes, “show me the money!” As a software provider, you can inspire Rod Tidwell’s enthusiasm by offering embedded finance as features in your software.

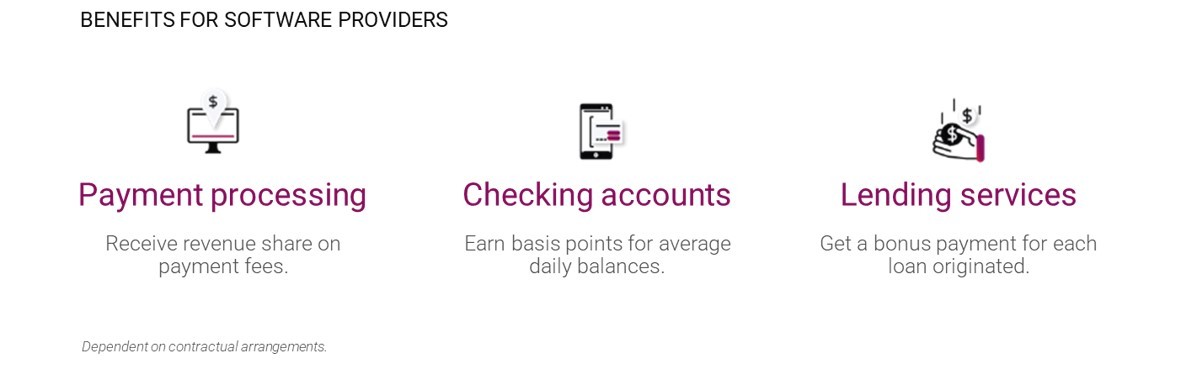

According to an article from Future, services like payments, banking, lending, and more can help increase revenue per merchant by 2-5 times. How? By centralizing some of the most critical features, business owners need to run their businesses. Embedded finance makes you their all-in-one provider.

By following the flow of money end-to-end, you can fully understand how, when, and where your business owners are moving money. This results in more opportunities to deepen relationships while tapping into new sources of recurring revenue.

5 steps to embedded finance nirvana

Business owners like finding smarter ways to run their business; don’t we all. When payments and banking services are delivered through a single platform, business owners gain better visibility into the cash flow (or transactions) that fuel their business. One example is quickly matching payment activity with bank deposits.

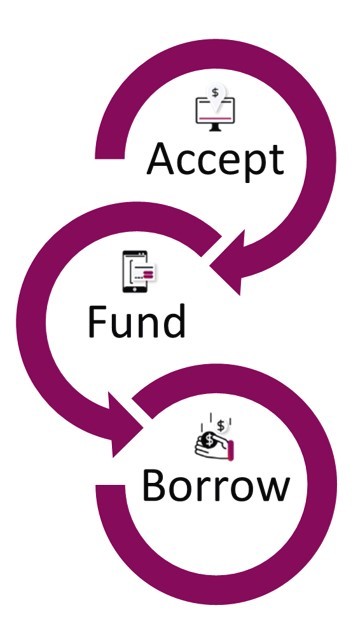

Here’s how embedded finance should work:

- Integrate with ease: A software provider uses one simple interface to integrate payments and banking into their software. Then, they start offering embedded finance services to their business owners under their brand.

- Simplify enrollment: Goodbye multiple applications! One easy online form lets business owners instantly activate payments and deposit the funds into a free business bank account secured by a regulated bank.

- Accept more payments: When a business owner accepts a payment -- in person, online, invoices, or recurring/subscription -- it's initiated within a software provider's core. The business owner enjoys a consolidated view of transactions and customer purchase history.

- Link bank deposits: Profits from payment processing automatically flow into the business owner's bank account, which can be easily accessed from an online portal or mobile app. A Visa® debit card showcasing the software provider's brand allows the business owner to make purchases or withdraw funds.

- Reinvest with lending services: The business owner can easily tap into working capital to invest back into their business. Because the software provider understand the business owner's transaction history and bank balance, lending decisions are fast and less risky.

Can you feel the tingle? Offering the right solution for your business owner needs, when they need it, helps you solve more of their problems. This helps you become the go-to provider they love, trust, and recommend.

Bank on your platform

Piecing together embedded finance services from multiple providers is messy. As the software provider, you’ve got to manage integration, testing, onboarding, and production cycles. Add in the pain of maintaining multiple relationships while remaining compliant with federal and state regulations. Woof.

Finding a partner backed by a federally regulated bank with a long history of innovation - like Synovus Bank, Member FDIC - simplifies the experience to one relationship, one contract, and one integration layer. What else does Maast do? We manage your funding, underwriting, compliance, and support so you can get to market faster and offer business owners a simple onboarding experience.

In general, choosing the right embedded finance partner lets you stay focused on your core business. And the right partner helps create new sources of revenue. When looking at potential embedded finance partners, it’s good to look for these attributes:

- A platform backed by a stable, regulated bank

- The opportunity to offer a fully branded experience

- Integration and access to all solutions via a single API

- One onboarding portal for you and your business owners

- A roadmap built for the future with scalable innovations

When you follow the money with a partner like Maast, it's easy for you to offer services your business owners need -- ultimately showing you more money.

Visit maast.com to learn more about how you can bank on your platform with Maast.