Pressed by a potential looming recession and need to cut costs, businesses are motivated as never before to operate as efficiently as possible.

To do so, many business owners are streamlining their work, looking for a Swiss Army Knife approach to financial services that will reduce the number of vendors they need to keep their doors open.

For 2023, as financial pressures increase, a trend toward embedding financial services will only grow. McKinsey notes that the number of new entrants in embedded finance will double in the next three to five years.

Yet not all embedded finance fintech providers will be on an equal footing. New entrants to the market will struggle without the expertise needed to navigate complex banking rules and the vagaries of different industries.

As we approach the new year, here are the trends that I see occurring in the embedded finance space:

More banks will try for a piece of the pie

Larger banks may be turned off by embedded finace, seeing this as a move toward disintermediation. But small, regional banks will look to expand their footprint and brand recognition by attempting to enter the embedded finance market. Those that already have existing, strong relationships with potential customers such as ISVs will benefit most.

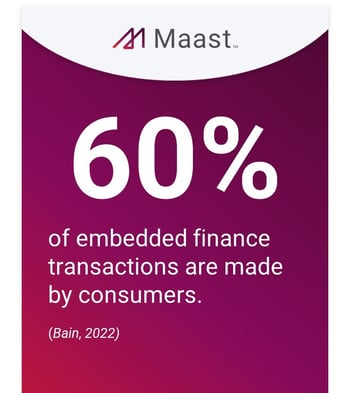

The gap shrinks between B2B and B2C embedded finance offerings

Today, B2C embedded finance options, like payment acceptance, are simply expected. But a number of B2B verticals, such as accounting and other professional services, are ripe for growth.

"One-stop-shop" will become more prevalent

From China's WeChat to the lifestyle ecosystems like ApplePay and Google Pay, businesses and consumers are looking to savvy software providers to dramatically reduce the steps needed to facilitate and speed up money movement and simplify routine processes by offering multiple features in their apps.

Solving vertical-specific needs will measure success

Embedded finance companies will succeed only if they understand the vertical market they’re looking to attract. As competition grows in the embedded finance business, companies should be partnering with their clients to understand vertical-specific pressures, differentiation and skill sets.

Bank backing will continue to be valuable

Non-bank fintechs will be increasingly challenged by government banking regulations. Unfamiliar with banking rules, fintechs not backed by banks will find it tough going as compared to those backed by banks that understand compliance issues.

Every new market opportunity, like embedded finance, attracts a slew of startups. Success will come to those who understand and can solve their clients' unique needs while balancing the underlying requirements of their own business with deeply rooted industry expertise.

You can learn more about where we think the future of embedded finance is headed by visiting maast.com.